On Wednesday, Germany announced its citizens should prepare for the potential of liquid natural gas (LNG) rationing as the Ukraine-Russia conflict rages on.

Reuters reports:

Germany triggered an emergency plan to manage gas supplies on Wednesday under which Europe’s largest economy could ration power if a standoff over a Russian demand to pay for fuel with rubles disrupts or halts supplies.

The report further notes that countries including France, Greece, and the Netherlands are considering rationing as well. Additionally, a report from The Hill claims Poland has announced it plans to end all its oil imports from Russia by the end of this year.

The bottom line? These nations (and others) will not bow to Russia’s demands anytime soon.

These actions, however, will create seismic shifts in the global energy market.

Unfortunately, the collateral damage will be higher energy prices through at least the end of 2022. If prices remain elevated at such high levels into 2023, the trickle down from this could have severe consequences across the entire globe, specifically in Europe and here in the United States.

If energy costs stay too high for too long, companies will stop producing goods because margins will be too tight and producing things (goods and services) will no longer be profitable. This will further reduce supplies across the board from food goods to services. This loss of supply will further amplify the effects of inflation, which further erodes consumers’ wealth. This compounds the demand destruction problem. In short, if energy costs are too high for too long, a recession will take hold in short order.

Oil’s Back Over $100, and European LNG Prices Are 3x Higher Than Last Year!

After a brief dip below $100, both West Texas Intermediate and Brent crude per-barrel prices are back above $100 this week, giving us further confirmation the surge in energy prices is far from over.

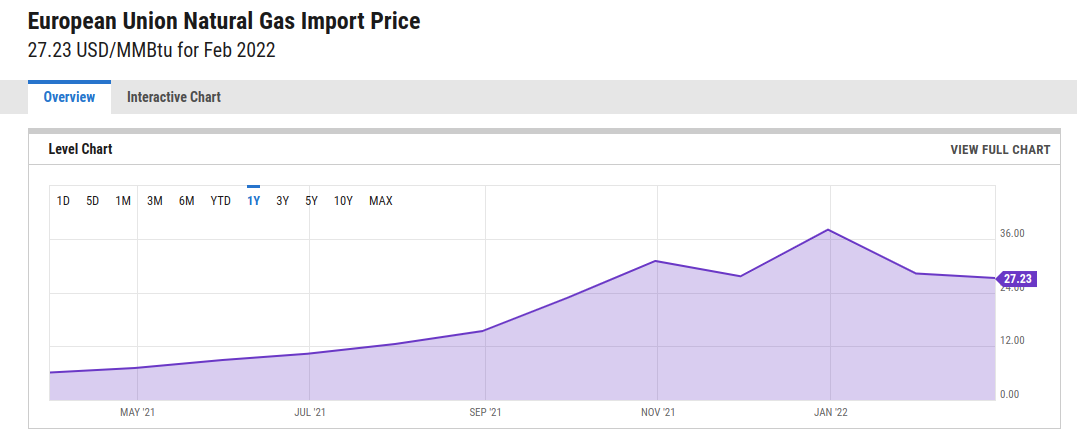

Looking at Europe’s spot LNG prices as of March 3, 2022, we can see they’ve more than tripled since the same time last year. It’s no wonder officials in Germany, Europe’s largest economy, are concerned about the current energy crisis and considering rationing.

Source: YCharts

This pressure on supply is having an effect here in the U.S. as well. We’re already seeing the trickle down with an increase in food prices and other staple goods as input costs on farming and distribution skyrocket. We’re also at risk of seeing growth slow. When you have rising inflation in a contractionary economic environment, that means stagflation.

It’s not 1982 — it’s 1973.

And much like in 1973 when the U.S. gas crisis was sparked by the Yom Kippur War between Israel and an Arab coalition led by Syria and Egypt, which pushed OPEC into an oil embargo on Israel’s supporters — i.e., the U.S. — we now have another war upending the global energy market.

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.The Best Free Investment You’ll Ever Make

Can We Avoid a 1970s-Like Global Energy Crisis?

The short answer, much to my delight, is yes. We can avoid another global energy crisis like the ones my parents endured through the ’70s and into the early ’80s…

That is, if we stop divesting the oil and gas industry here in the Western Hemisphere.

Simply put, with a little more insight into how things work, green energy lobbyists would accept the fact that the only way to properly facilitate a transition to greener, more sustainable sources of energy is by taking advantage of the vast quantity of cheap energy available with gas, oil, and nuclear power plants.

I know it’s not what ESG investors want to hear, but this is the only viable way forward. We must deal with a necessary evil until the solution is scaled out well enough to support 8 billion humans and counting!

The good news is if we get real about energy now, we can still avoid sustained high energy costs and avoid a global recession. And that could be a boon for Western LNG producers as they try to fill the gap in the world’s current energy supply.

Because who better than the U.S. and our Western energy partners to develop the world’s oil and gas resources with minimal impact to the environment? I mean, do you really want China’s and Russia’s questionable industrial standards to become the norm?

Without smart oil and gas investment here in the Western Hemisphere, we leave the bulk of energy supply to nations that do not believe in green practices like we do. And that should be much scarier to ESG and green energy investors than trusting companies like Baker Hughes Co. (NYSE: BKR), Chevron Corp. (NYSE: CVX), or even South American companies like Petrobras (NYSE: PBR).

This leads me to my urgent message for you today.

Petrogonia and the New Shale Revolution

From 2011 to 2014, oil traded above $90/bbl and popped over the $100 level several times.

Those long-term elevated prices set the stage for the American shale revolution, which turned the U.S. into the world’s No. 1 oil and gas producer by 2018.

The problem is, with demand so high and only expected to grow, coupled with geopolitical conflicts continually threatening supply, the U.S. energy revolution over the past decade still isn’t producing enough oil and gas to keep costs low and stave off stagflation and a recession.

That’s even after the Biden administration recently flip-flopped on opening federal lands for oil and gas exploitation.

And that’s where “Project Petrogonia” steps in.

In the Andes Mountains of Argentina, there’s a company setting the stage for a second shale revolution.

It’s working on what’s been dubbed “Project Petrogonia.” In short, it’s the development of the second-largest shale oil basin in the world. This vast untapped basin of cheap energy stretches for roughly 12,000 square miles and contains an estimated 14.4 billion barrels of oil equivalent worth trillions of dollars.

Learn how to claim your stake in “Project Patagonia” today!

To your wealth,

Sean McCloskey

Editor, Energy and Capital

After spending 10 years in the consumer tech reporting and educational publishing industries, Sean has since redevoted himself to one of his original passions: identifying and cashing in on the most lucrative opportunities the market has to offer. As the former managing editor of multiple investment newsletters, he's covered virtually every sector of the market, ranging from energy and tech to gold and cannabis. Over the years, Sean has offered his followers the chance to score numerous triple-digit gains, and today he continues his mission to deliver followers the best chance to score big wins on Wall Street and beyond as an editor for Energy and Capital.

@TheRL_McCloskey on Twitter

@TheRL_McCloskey on Twitter